Vital Tips for Getting one of the most Out of Your Home Loan Calculator

Smart Finance Calculator Service: Streamlining Your Financial Calculations

In the realm of economic monitoring, efficiency and accuracy are critical. Think of a device that not only streamlines complicated loan computations however additionally gives real-time insights into your economic dedications. The smart lending calculator remedy is made to streamline your economic calculations, using a smooth means to assess and intend your financings. By harnessing the power of automation and progressed formulas, this device surpasses plain number crunching, transforming the means you come close to financial planning. Whether you are an experienced financier or a new consumer, this innovative remedy assures to redefine your monetary decision-making process.

Advantages of Smart Car Loan Calculator

When assessing financial alternatives, the benefits of using a clever car loan calculator come to be evident in helping with notified decision-making. By inputting variables such as car loan quantity, passion rate, and term length, individuals can analyze various situations to select the most cost-efficient alternative customized to their financial scenario.

Furthermore, smart financing calculators offer transparency by breaking down the total cost of borrowing, including rate of interest repayments and any type of extra costs. This openness equips individuals to recognize the economic ramifications of getting a finance, allowing them to make audio economic choices. In addition, these devices can conserve time by giving instantaneous estimations, removing the requirement for hands-on computations or intricate spread sheets.

Features of the Device

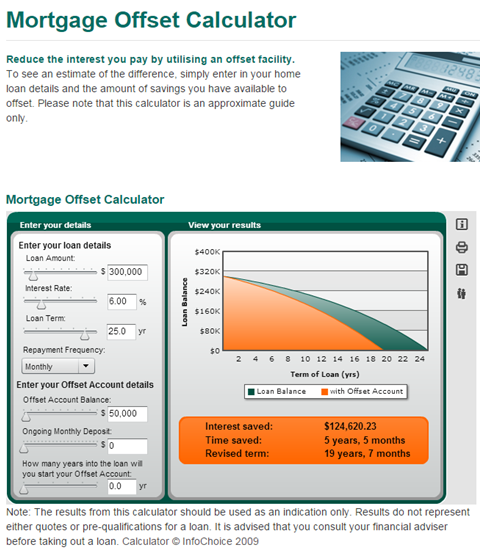

The tool incorporates an user-friendly user interface developed to streamline the procedure of examining and inputting funding data successfully. Users can conveniently input variables such as funding amount, rate of interest, and finance term, permitting quick estimations of regular monthly settlements and total rate of interest over the lending term. The device additionally provides the versatility to change these variables to see how adjustments affect the general car loan terms, empowering individuals to make enlightened financial decisions.

In addition, the smart financing calculator supplies a failure of each regular monthly repayment, revealing the portion that goes in the direction of the primary amount and the passion. This feature assists customers visualize how their settlements add to paying off the finance gradually. Moreover, customers can create in-depth amortization timetables, which lay out the payment schedule and interest paid each month, helping in long-term financial planning.

How to Utilize the Calculator

In navigating the finance calculator efficiently, users can conveniently take advantage of the straightforward user interface to input essential variables and produce important financial understandings. Individuals can additionally define the payment frequency, whether it's month-to-month, quarterly, or every year, to align with their financial preparation. By adhering to these basic steps, individuals can efficiently utilize the finance calculator to make informed financial choices.

Benefits of Automated Calculations

Automated computations streamline monetary procedures by quickly and find more accurately computing complex figures. Manual estimations are susceptible to blunders, which can have significant ramifications for financial decisions.

Additionally, automated computations save time and boost effectiveness. Facility financial computations that would normally take a substantial quantity of time to finish manually can be performed in a portion of the moment with automated devices. This allows economic experts to concentrate on evaluating the results and making informed choices as opposed to investing hours on calculation.

This uniformity is important for contrasting different monetary situations and making audio financial options based on precise data. home loan calculator. Generally, the advantages of automated estimations in improving economic processes are undeniable, supplying enhanced precision, click for more info effectiveness, and consistency in complicated economic calculations.

Enhancing Financial Planning

Enhancing monetary preparation includes leveraging innovative devices and methods to maximize financial decision-making processes. By utilizing sophisticated monetary planning software application and companies, calculators and individuals can obtain much deeper insights right into their economic health and wellness, established realistic goals, and create workable strategies to achieve them. These devices can examine different financial situations, project future end results, and offer referrals for efficient riches administration and threat mitigation.

Additionally, boosting monetary planning includes integrating automation and expert system right into the process. Automation can enhance regular monetary tasks, such as budgeting, cost monitoring, and investment surveillance, liberating time for strategic decision-making and analysis. AI-powered tools can use customized monetary guidance, identify fads, and recommend optimal financial investment possibilities based upon private danger accounts and financial goals.

In addition, cooperation with monetary experts and professionals can enhance monetary preparation by using valuable insights, market expertise, and customized approaches customized to particular monetary goals and conditions. By incorporating sophisticated tools, automation, AI, and specialist suggestions, people and companies can elevate their financial preparation capacities and make informed choices to protect their financial future.

Verdict

In final thought, the clever financing calculator i loved this remedy supplies numerous advantages and attributes for improving economic calculations - home loan calculator. By utilizing this tool, users can easily determine finance repayments, rate of interest rates, and payment timetables with accuracy and performance. The automated computations offered by the calculator improve economic preparation and decision-making processes, ultimately leading to better financial monitoring and notified options

The clever loan calculator option is made to streamline your economic computations, providing a seamless way to analyze and plan your finances. In general, the advantages of automated estimations in improving monetary processes are indisputable, offering raised accuracy, performance, and consistency in intricate monetary computations.

By using innovative monetary preparation software and individuals, businesses and calculators can acquire deeper understandings into their economic health and wellness, established sensible objectives, and develop workable strategies to attain them. AI-powered devices can supply individualized economic suggestions, identify patterns, and suggest optimum investment chances based on specific danger profiles and monetary purposes.